Table of Content

It is meant to satisfy the member's immediate credit needs. The lower and middle classes can now own their dream homes thanks to Pag-housing IBIG’s loans, including rent-to-own homes. The property seeker must first be a Pag-IBIG member with at least 24 months of contribution in order to be eligible for the organization’s programs. Pag-IBIG payments are typically included in the list of obligatory perks that employers must provide to their staff. There is a voluntary donation option available to self-employed people.

You can borrow anywhere between PHP10,000 and PHP1,000,000, depending on your monthly income and financial requirements. To avail of any of these loan options, the OFW must have been working abroad for at least 2 years with a monthly income of P50,000 for the Auto Loan and P10,000 for all other OFW loan types. Moreover, borrowers must be 25 years old or older but not more than 65 years old upon loan maturity. Learn more about the available options for OFW Loans from BDO here. There are many banks to choose from when it comes to home loan financing. One of the best ways to get started with deciding where to get a bank loan is to do research on various financial institutions that interest you or with the ones you’re currently using.

Welcome Bank Condominium Loan

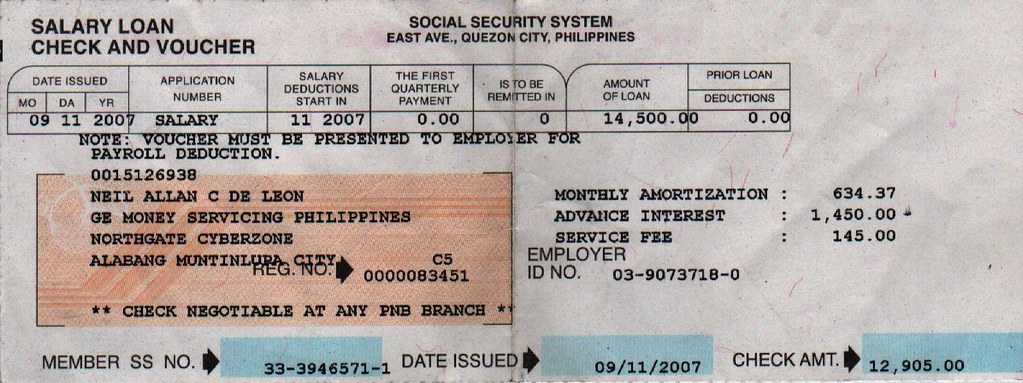

When you’re applying for it, your SSS loan should be the average of your 12 months posted Salary credits. The loan has to be paid within two years in 24 monthly installments. The monthly payment shall start on 2nd month of which the loan has been taken. Hat do you do when you suddenly run out of money and can’t even buy food or pay for the doctor?

Anyone can have an emergency in their lives and not many people are lucky to have a financially stable family background. These sorts of loans protect our independence in the hour of need. SSS guides is NOT the official website of the Philippine Social Security System. We only intend to provide helpful tutorials and information to help SSS members. We DO NOT collect any information regarding your account, Please DO NOT post or give your information online.

Best OFW Loans in the Philippines (Banks and Government Agencies)

The sss loan is the most availed loan program of the SSS . Under the program, members may borrow up to twice the average of their 12 latest posted monthly salary credits. It is payable in 24 monthly installments with an interest rate of 10 percent per annum based on its diminishing principal balance. IMoney has created a housing loan calculator that makes calculating the monthly repayments and comparing rates across all banks easy for you. To use the mortgage calculator, just scroll up to the top of this page, type in the property price that you would like to borrow, and for how long are you willing to pay for it.

Therefore, if you do not have millions in your bank account, do not despair; you can still finance a house purchase. Indeed, the government provides assistance to individuals who wish to purchase a property, and the Social Security System is one of them. You have the option of paying your monthly loan repayments by check or automatic debit. Payments can also be made in-branch, online, over the phone, or at an SM bills payment center.

Social Security System (SSS) OFW Loan

The online application process only takes a few minutes to complete. Once all the required information has been submitted, approval will be given within five to seven working days. Various loan amounts.Depending on your credit rating and the amount of money that you can borrow, you can borrow up to PHP1,000,000. Project-Based Financing – This feature allows the DBP/LBP/SSS funded clients to lock-in the terms and interest rates of their loan. New car loans are available for up to 60 months, while used car loans are available for up to 48 months.

Your loan application usually takes around 1 to 3 working days to get approval. Once it’s approved, you’ll receive your PSBank Flexi card and temporary PIN. The amount that you’re allowed to borrow increases depending on the amount that has already been paid. This allows you to have more control over how much money you borrow. PSBank’s Flexi Personal loan comes with a variety of features, such as a revolving credit line and a fixed term.

The primary purpose of this organization is to provide members with insurance against specific unforeseen events in exchange for a monthly fee. Abot Kaya Pabahay Fund-Development Loan Program (AKPF-DLP)– The AKPF-DLP can assist low-income urban city dwellers by providing financing for the construction of homes or other structures. However, these aforementioned residences must be a part of a certain housing project or the community mortgage program .

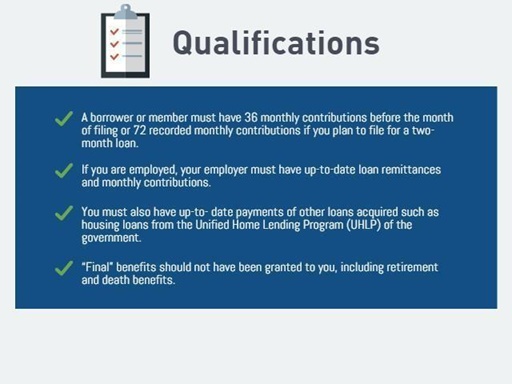

The member must also be updated in the payment of other loans with SSS. An Educational loan is extremely important for youngsters who want to study or parents who want to send their kids to school or college but cannot afford it. They can opt for educational loans to complete their education by paying back the money gradually.

It can be used to purchase a lot and build a home, buy an existing one, or construct a house on an owned lot. This is the lowest rate of interest among the SSS housing loan programs. You can apply for a loan of up to ₱2,000,000, with an interest rate of 11% per year.

If you want to build a fence and gate around your home, make sure that the materials are concrete or steel. You can borrow up to ₱1,000,000 at an interest rate of 9% per annum. If you apply for a period longer than 15 years, the interest rate will be re-calculated. You will have to pay a processing fee of 12 of 1% of your loan amount, or ₱500, but it will not be more than ₱3,000. The SSS is so strict about the intended purpose of the loan that it requires an inspection to ensure the rules are followed. The processing fee will be deducted from the first loan release.

Because it can create some problems when applying for a loan before paycheck according to SSS requirements. Secondary documents are a credit card, an identity card, a certificate of alien registration, etc. If you are planning to buy your own home, you can browse our list of condominiums and houses for sale. Has not been previously granted a repair and improvement loan by the SSS or NHMFC . Applicant must be up-to-date in all existing loan accounts with SSS subject to verification by SSS-Real Estate Department. Long-term resident overseas Filipinos who wish to avail of housing packages either for themselves when they retire or when they visit the Philippines and/or for their extended families.

A one-month loan is equivalent to the average of member’s last twelve Monthly Salary Credits , or the amount applied for, whichever is lower. A processing fee equivalent to 1/2 of 1% of loan amount of Php500 whichever is higher, but not exceeding Php 3,000 will be deducted from the first loan release. There will also be an inspection fee of P500 to be shouldered by the borrower. Borrower and spouse is updated in the payment of their other SSS loan, if any.

Although your income and credit are the two main things lenders take into account, they don’t tell the complete story. As a result, you can be turned down for additional reasons, such as your employment history, the stability of your housing, or cash flow or liquidity issues. When youapply for a loan, lenders will primarily look at your credit history and credit score. Lenders may decide that you are a borrower who is too hazardous to approve at this time if they notice any big negative items on your credit report or other warning signs. Community Mortgage Program – Through the CMP, legally constituted Informal Settlers in economically struggling areas can get assistance financing their homes.

No comments:

Post a Comment